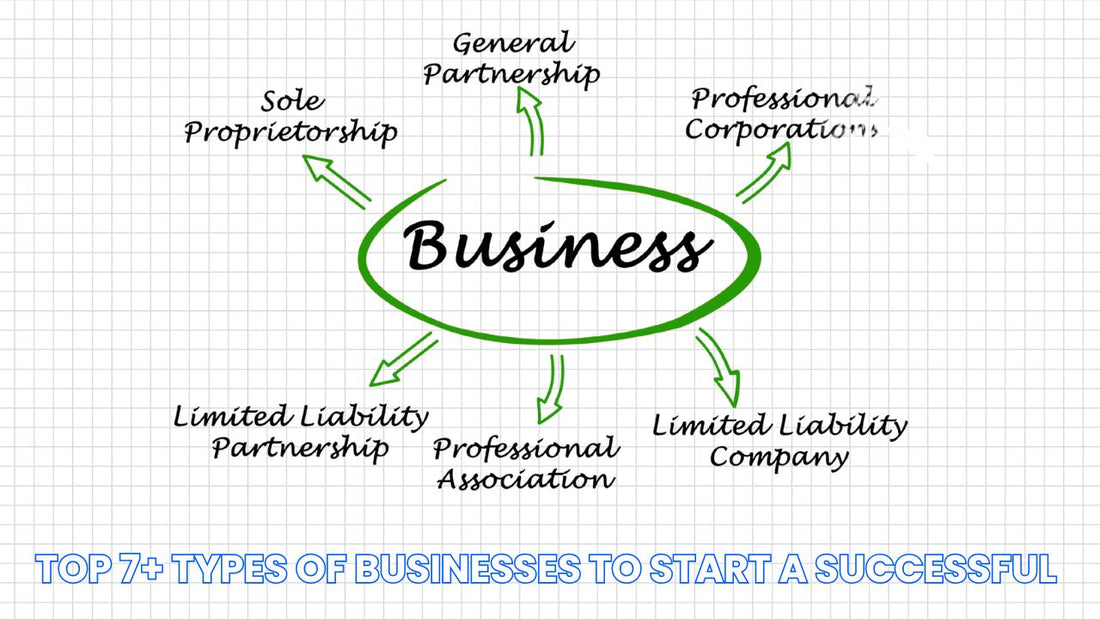

Discover 7 Types of Businesses to Start a Successful Business

Table of Contents Hide

Starting a business is an exciting journey, but one of the first and most critical decisions you’ll make is choosing the right types of business. In this article, NextSky provides a detailed overview to help you make an informed decision aligned with your goals.

TOP 7 types of businesses to start a successful business

Below, we explore the primary business structures, including their characteristics, benefits, and ideal use cases. Each is designed for different business models, risk levels, and growth ambitions.

1. Sole proprietorship

A sole proprietorship is the simplest and most accessible business structure, owned and operated by a single individual. In many cases, you can start operating without formal registration.

Key features:

- Ownership: One person manages and controls everything.

- Legal liability: The owner faces unlimited liability, meaning personal assets (home, car, savings) are at risk if the business incurs debt or legal issues.

- Taxes: Profits and losses are reported on the owner’s personal income tax return, simplifying tax processes.

- Setup: Minimal paperwork, often requiring only a business license or local certification.

- Examples: Freelancers, consultants, small online stores, or personal trainers.

Advantages:

- Easy and low-cost to start.

- Full control over all decisions.

- Simplified tax reporting.

Disadvantages:

- High risk due to unlimited liability.

- Difficult to raise capital since shares or ownership cannot be sold.

- Not suitable for large-scale growth.

Ideal for: Low-risk ventures, side hustles, or those testing ideas before significant investment. Many successful entrepreneurs started this way—e.g., Pierre Omidyar launched eBay as a sole proprietorship in 1995 before it grew into a corporation.

Read more: How to Start a Business in 14 Simple Steps to Success

2. Partnership

A partnership is formed by two or more individuals who share capital, profits, and responsibilities. It’s a simple structure often chosen for collaborative ventures, with three common types: general partnership, limited partnership, and limited liability partnership.

General partnership:

- Ownership: Two or more partners with equal rights and responsibilities.

- Legal liability: Partners face unlimited liability for the business’s financial and legal obligations.

- Taxes: Profits are reported on each partner’s personal tax return.

- Suitable for: Professional service businesses like law firms, architecture practices, or shared-capital ventures like restaurants.

Limited partnership:

- Ownership: Includes general partners (who manage and face unlimited liability) and limited partners (who contribute capital and have limited control and liability).

- Taxes: Profits are distributed based on capital contributions; general partners pay self-employment taxes.

- Suitable for: Short-term projects or specific investments, like film production or real estate.

Read more: How Much Does It Cost to Start a Business? Budgeting Tips

3. Limited liability company (LLC)

An LLC blends the management flexibility of a partnership with the asset protection of a corporation, making it a top choice for small and medium-sized businesses.

Key features:

- Ownership: Can be owned by one or more members (individuals or entities).

- Legal liability: Members have limited liability, protecting personal assets from business debts or lawsuits.

- Taxes: Defaults to personal income tax but can opt for corporate taxation if strategically beneficial.

- Setup: Requires filing articles of organization and an operating agreement in most states.

- Examples: Forbes, Deloitte, and Kind operate as LLCs.

4. Corporation

A corporation is a separate legal entity from its owners, offering the strongest liability protection for shareholders but with stricter administrative and legal requirements. Different types of corporations serve varying goals and strategies.

C corporation (C Corp):

- Overview: The most common and standard corporate structure, fully independent from its owners.

- Ownership: Can have one or multiple shareholders, managed by a board of directors.

- Legal liability: Shareholders have limited liability, tied to their investment.

- Taxes: Faces double taxation—corporate profits are taxed, and dividends to shareholders are taxed again as personal income.

- Suitable for: Businesses aiming to go public, raise significant capital, or expand globally, like Apple or Target.

S corporation (S Corp):

- Overview: Similar to a C Corp but avoids double taxation with tax benefits.

- Ownership: Limited to 100 U.S. citizen shareholders and one class of stock.

- Legal liability: Shareholders have limited liability.

- Taxes: Profits pass through to shareholders’ personal tax returns, avoiding corporate-level taxation.

- Suitable for: Small to medium businesses meeting IRS criteria, seeking corporate protection with tax optimization.

Closed corporation:

- Overview: A private corporation with simpler legal requirements, often run by families or close-knit groups.

- Ownership: Limited shareholders, with non-publicly traded stock.

- Legal liability: Shareholders have limited liability.

- Taxes: Typically taxed as a corporation unless registered as an S Corp.

- Suitable for: Family businesses or small firms, like Publix or Kohler.

Benefit corporation (B Corp):

- Overview: A for-profit corporation committed to social or environmental goals alongside profit.

- Ownership: Similar to C Corp or S Corp, depending on structure.

- Legal liability: Shareholders have limited liability.

- Taxes: Typically taxed as a corporation unless registered as an S Corp.

- Suitable for: Businesses balancing profit with social impact, like Warby Parker.

Read more: 7 Ways to Start Business Without Money for New Entrepreneurs

5. Nonprofit corporation

Nonprofits are established to serve a community or cause rather than generate profit. Revenue is reinvested to sustain and expand charitable, educational, or social activities, and qualifying organizations may receive tax exemptions.

Key features:

- Ownership: No shareholders; managed by a board of directors.

- Legal liability: Directors and staff have limited liability, protecting them from legal risks.

- Taxes: May qualify for tax-exempt status under IRS Section 501(c)(3) if approved.

- Examples: Sierra Club, Habitat for Humanity—globally recognized for environmental and community support.

Advantages:

- Tax exemptions and access to grants and donations.

- Liability protection for founders and operators.

- Attracts like-minded individuals and organizations, building community strength.

Disadvantages:

- Strict regulations on profit use and distribution.

- Requires transparent record-keeping and detailed compliance reporting.

- Limited revenue generation compared to for-profit businesses.

6. Cooperative

A cooperative (co-op) is owned and operated by its members, customers or employees, for mutual benefit. Each member has equal voting rights, regardless of investment, fostering a democratic and equitable environment.

Key features:

- Ownership: Members contribute capital through shares, but voting rights are equal.

- Legal liability: Members have limited liability within their investment.

- Taxes: Income is taxed as personal income.

- Examples: REI (a consumer co-op) and Cooperative Home Care Associates (a worker co-op in healthcare).

Advantages:

- Democratic and transparent: Equal control encourages member participation in decisions.

- Fair profits: Revenue and benefits are distributed among members, not concentrated among shareholders.

- Social impact: Ideal for community-focused, sustainable businesses with social responsibility.

Disadvantages:

- Slow decision-making: Consensus-driven processes can delay policies or strategy changes.

- Limited capital access: Co-ops struggle to attract traditional funding or investment.

- Risk of conflict: Differing member interests can lead to internal disputes.

7. Joint venture

A joint venture is a temporary collaboration between two or more businesses (or individuals) to achieve a specific project or goal. Each party retains legal and operational independence but shares resources for mutual success.

Key features:

- Ownership: Rights and responsibilities are clearly divided among participants.

- Legal liability: Depends on the structure (e.g., LLC or partnership).

- Taxes: Tax obligations vary based on the chosen organizational model.

- Example: Renalytix AI and Mount Sinai Health System’s Kantaro Biosciences collaborated to develop a COVID-19 antibody test.

Advantages:

- Leverages combined capital, technology, and expertise for greater success.

- Parties maintain independent management and core operations.

- Flexible collaboration focused on specific projects, minimizing long-term investment risks.

Disadvantages:

- Risk of disputes without clear, transparent agreements upfront.

- Limited duration, less suited for long-term strategies.

- Dissolution and asset division can be complex if issues arise.

Ideal for: Projects requiring collaboration for product development, market expansion, or short-term strategic goals, where parties want to share opportunities while remaining independent.

Why the business structure matters

The business structure is the legal framework that defines how your business operates, how it’s taxed, and who bears the risk. It impacts:

- Tax obligations: Determines whether profits are taxed at the corporate, individual, or both levels.

- Legal liability: Affects whether your personal assets are at risk in cases of debt or lawsuits.

- Raising capital: Influences your ability to attract investors or secure bank loans.

- Operational flexibility: Shapes decision-making processes and administrative requirements.

- Growth potential: Impacts scalability and the ability to issue public stock. Choosing the wrong structure can lead to higher taxes, increased legal risks, or operational inefficiencies. This guide covers the most common business structures, their advantages, disadvantages, and real-world examples to help you decide confidently.

How to choose the right business structure

Selecting the best structure depends on several factors. Here’s a step-by-step guide to help you decide:

- Balance purpose and profit: Prioritize social or environmental missions with a nonprofit or B Corp. For profit and flexibility, an LLC or C Corp optimizes long-term growth.

- Assess risk: High-risk industries with legal or debt exposure benefit from LLCs or corporations to protect assets. Low-risk ventures can use simpler sole proprietorships.

- Consider tax implications: Sole proprietorships, partnerships, LLCs, S Corps, and co-ops use personal income tax, simplifying filings but requiring self-employment taxes. C Corps face double taxation but suit expansion and fundraising; nonprofits may be tax-exempt but restrict profit distribution.

- Plan for the long term: C Corps are ideal for public listings. LLCs, co-ops, or nonprofits suit small to medium growth or social missions.

- Check local regulations: Tax and liability laws vary by country or state. Consult local authorities or advisors to ensure compliance.

- Align with goals: Social missions favor nonprofits or B Corps, while profit-driven ventures lean toward LLCs or C Corps.

Choosing the right types of business is a critical step toward launching a successful venture. By understanding the nuances of each structure, you can align your choice with your business goals, risk tolerance, and growth ambitions.